“The investor’s chief problem – and even his worst enemy – is likely to be himself” Benjamin Graham.

Achieving investment success extends well beyond asset allocation, diversification, and good performance, to name a few. An often overlooked and misunderstood factor that exerts a profound influence on investment decisions is the complex interplay of human emotions and behaviour. Behavioural finance has been a hot topic lately, but not hot enough.

What is behavioural finance?

Behavioural finance is the study of how psychological and emotional factors influence the way we think and make decisions. It combines psychology and economics to explore how our emotions, cognitive biases and social influences affect financial decisions. Understanding behavioural finance adds enormous value to the management of a client’s investment portfolio. Traditional finance models often assume that individuals make rational, objective decisions, but behavioural finance acknowledges that real-world decisions are often far from purely logical.

Investors should be mindful of common behavioural biases which can ‘lead them astray’. Some of these biases include:

- The overconfidence bias: A person’s tendency to overestimate their knowledge and ability to predict the market. They fail to recognise the difference between controllable and uncontrollable events.

- The loss aversion bias: Investors who are more sensitive to losses compared to gains. They tend to hold onto underperforming investments for too long and sell overperforming investments too early, because of the intense fear of loss.

- The availability bias: Refers to an individual’s tendency to make decisions based on the most available information and any previous experiences that are easily recalled.

- The regret aversion bias: Where investors seek to avoid the emotional pain of regret, associated with their poor decision-making. It’s the ‘what is’ and ‘what might have been’.

- The representativeness bias: When investors rely too heavily on preconceived notions or stereotypes, leading to incorrect decision-making based on an assumed identical situation where important differences exist.

- The framing bias: The tendency to make decisions based on the way information has been presented. The same facts presented in two separate ways can lead to different decisions being made.

Why should I be mindful of behavioural biases?

Failure to recognise and manage behavioural biases can result in detrimental effects:

- Excessive trading leading to poor market timing, unnecessary transaction costs, taxes and poor performance.

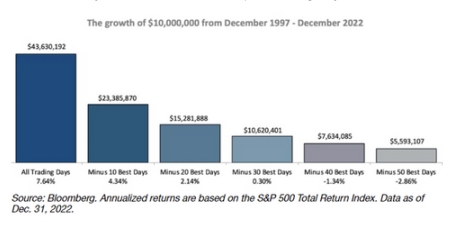

- The danger of being out of the market, reflected clearly in the below graph. If you stayed in the market and held the S&P 500 for all trading days from 1997 to 2022, your returns could have been 7.64% per annum, versus the 0.30% per annum if you missed the 30 best-performing days.

- Impulsive decisions, where limited research has been done and decisions are made to buy and sell, usually, at the worst possible times.

- Investments underperforming resulting in excessive losses.

How do I manage these behavioural biases?

- Set clear objectives and conduct regular reviews to make sure that you are on course with your original objectives and goals.

- Education and research. Be aware of behavioural biases, and always make sure you have sound backing by research when making investment decisions.

- Stay informed. Be aware of market trends and economic events to help you make informed decisions and prevent being irrational during turbulent times.

- Have a long-term focus to outweigh short-term market volatility.

- Approach a financial advisor. A qualified and professional financial advisor is there to help you make informed decisions which align with your investment strategies and long-term goals. They can help you become aware of your behavioural biases and help you stay the course.