We recently returned from a weekend away with some friends, one of whom emigrated last year. The news of our friends’ departure took us by surprise. While I am sure that the decision was not taken lightly and was given significant consideration, it made me think of risk and the potential for outcomes to disappoint despite the amount of thought applied. As with investing, the prospect of a better outcome or an exciting adventure can be very appealing, however, too much focus on the prospect of a positive life changing outcome, can potentially present significant problems as the excitement fades and the seemingly ‘obvious’ rewards come face to face with the realities of significant changes in circumstance.

The current boom in alternative assets and speculative investments can lead to a serious case of FOMO – nobody wants to be the only one at the dinner table unable to participate in the conversation about how well their investments are doing.

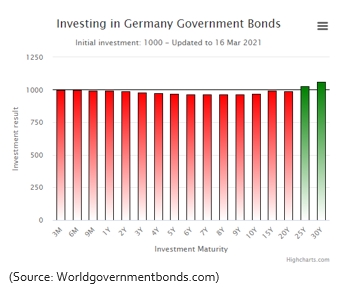

One of the most important objectives of investing is to store wealth and preserve buying power. Any important investment decision requires consideration of whether the returns adequately compensate the investor for the risk being taken. Consider the table below showing the yields on the German sovereign bonds – all but the 25-year bond have a negative yield. Simplistically this means buyers are prepared to lend the German government money and get back less than the principal at maturity and this is before we take inflation into consideration. Considering how hard you work for your money, this does not sound like adequate compensation.

The very low interest rates on offer have encouraged investors to seek out higher yields and take on additional risk. Recent reports have revealed the significant financial stress that can result from moving up the risk curve, as was seen in the Greensill Capital and Archegos Capital Management collapse. Archegos was a highly leveraged* hedge fund operating under the guise of a family office – the fund reportedly had assets of $10 billion and leveraged this to trade up to $80 billion in a complex set of arrangements which are likely to face some scrutiny. Little information is available on what caused Goldman Sachs and Morgan Stanley to initiate the margin calls* that resulted in selling orders of between $10 billion and $20 billion on a Friday afternoon in March, leaving Credit Suisse with substantial losses.

The days following these events likely saw risk managers frantically looking at the amount of leverage they were exposed to against the capital held as margin. The significance for investors is the mechanics of the risk adjustment process and subsequent deleveraging.

*In simple terms a leveraged account allows an individual to provide the bank with security similar to a deposit and trade much more than this on condition that they maintain the deposit level e.g. at 10%. Should the deposit fall below 10% the bank will ask for a top-up or margin call. If this cannot be made, the bank is entitled to sell some assets to maintain the deposit amount.

Risk in financial markets is ever present and often factored into asset prices very rapidly, but it is the unexpected or unknown unknowns that cause extreme volatility. Asset allocation spreads some of the risk and contributes to less volatility in investment portfolios with research showing that it is responsible for a large portion of the variability of investment return. As custodians of our clients’ funds, we take great care and consideration in determining where to allocate capital and as such evaluate various asset classes with respect to their respective risks and benefits as an integral part of the Harbour Wealth investment process.

There are aspects to planning for retirement that cannot be controlled or influenced such as market returns, government policies on tax or interest rates, however, one of the primary things that we can have absolute control over is asset allocation. This allows us to provide appropriate advice for an individual’s specific circumstances and assist clients with developing their financial strategy and the appropriate solution to achieve it.

If you require professional financial advice, contact one of our qualified independent Financial Advisors at www.harbourwealth.co.za