Father’s Day is always a time of reflection for me, as I am sure it is for many. I often wonder what my dad would say to me after all this time. Would he be proud? What advice would he give me? Will everything be, okay?

He passed away at 60 when I was 21, with his only regret being that he was taken from us too soon. In his own words, he had accomplished everything he wanted to in his life, and we were not to ever think otherwise. This statement has always stayed with me and influences everything I do in my private and professional life. I just hope I may be able repeat the same words that he did before I depart for the pearly gates.

If there were year books in South Africa back then, my father would probably have been voted “most likely not to succeed”, if he even arrived for the school photo that is. In the words of my mum: “He needed school like a hole in the head!” This resulted in him being summarily failed in his Standard 9 year at school and forced to repeat it. On entering the job market, he quickly became disillusioned with the many jobs he tried his hand at. If repeating Standard 9 wasn’t enough, he then chose to rewrite matric after school through a night school, to improve his chances of being accepted to a university.

Dr R.G. Wilson became the oldest person to qualify as a doctor at the time in 1982, at the age of 40. He paid his way through medical school by selling snook and living off a diet of cabbage and pork bangers four days a week.

After conquering all these challenges and succeeding, he entrusted the financial profession with the same level of care his patients and profession expected from him, only to be betrayed miserably.

I refuse to accept this and after all this time, realise that our professions were not as far removed as I thought, as our purpose is improving someone’s life.

Before you examine the body of a patient,

Be patient to learn his story.

For once you learn his story,

You will also come to know

His body.

Before you diagnose any sickness,

Make sure there is no sickness in the mind or heart.

For the emotions in a man’s moon or sun,

Can point to the sickness in

Any one of his other parts.

Before you treat a man with a condition,

Know that not all cures can heal all people.

For the chemistry that works on one patient,

May not work for the next,

Because even medicine has its own

Conditions.

Before asserting a prognosis on any patient,

Always be objective and never subjective.

For telling a man that he will win the treasure of life,

But then later discovering that he will lose,

Will harm him more than by telling him

That he may lose,

But then he wins.

(The Maxims of Medicine by Suzy Kassem)

A medical practitioner is the curator of one’s health, whereas we are the curators of our clients’ livelihoods.

Despite the critical impact that poor financial outcomes may have on someone’s life, we still seem to refuse to hold financial services to the same ethical and professional standards, as we do our doctors. We often engage with clients who have been told that they will receive the treasure of a comfortable retirement, when in fact, the true financial prognosis is terminal. We bear witness to the effects that a poor financial outcome has on a person’s physical and mental health, and yet; we still do not demand the same level of due process and care for our financial wellbeing, as we do for our physical?

The Foundation – Diagnostic Processes

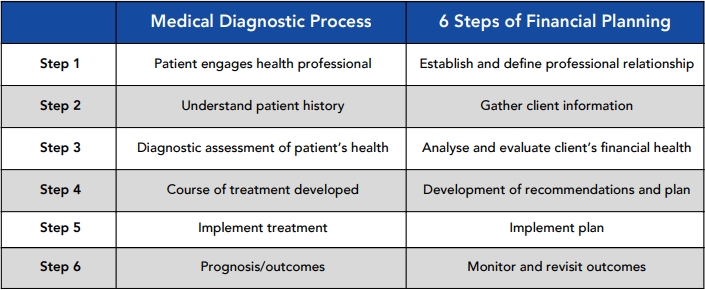

Each profession has its own “diagnostic” process, generally encapsulated in industry laws, and safeguarded by professional bodies. The universally accepted diagnostic process in financial planning is identical to that of medicine, but it’s in the application thereof, that consumers should be afraid of:

To illustrate the difference in application and consumer expectation, consider the following two scenarios, should you or a loved one become ill:

Scenario 1 – Diagnosis Determined the Remedy

- After a short phone call with your doctor, briefly discussing some of your symptoms, they immediately prescribe schedule 7 medication, followed by the removal of your spleen.

- A month later your dear nan falls ill, exhibiting completely different symptoms to your recent bout of ill-health.

- After a short call with the doctor and brief discussion around her symptoms, they immediately prescribe schedule 7 medication, followed by the removal of her spleen.

- If the removal of your spleen wasn’t cause for concern, then Nan’s upcoming Splenectomy should be, as hers was removed back in 1974 following a motor vehicle accident.

- On questioning the diagnosis, you’re told that this treatment works 40% of the time, every time.

Be wary of a medical professional who prescribes a course of treatment, before accurately understanding the problem or ailment first.

There is a flippant undertone to my over simplified example, but this is essentially how 80% of the financial service industry operates today. There is a “one size fits all” or “off the shelf” policy, where the product or treatment determines the advice and not the other way around.

Scenario 2 – Impartial Diagnoses

- You’ve recovered well after the removal of your spleen – who needed one anyway I hear you say?

- In a follow up call with the doctor’s rooms, you learn that they will be joining ABC Pharmaceuticals, after which they will only prescribe ABC’s pharmaceuticals, irrespective of their ability to treat your spleen issue.

Could you imagine the ill practice and health that would ensue, if doctors were not able to choose the best treatment for you or even worse; were precluded from doing so?

Advice, irrespective of the profession, must be objective or untainted by undue influence.

People will often glaze over when I use the term “objective” in conversation, so for those readers that may use different adjectives in their respective professions, please find a comprehensive list of synonyms:

Impartial | Factual | Real | Tangible | Unbiased | Unprejudiced | Non-partisan | Neutral

A doctor receives no financial incentive for the pharmaceuticals they prescribe or the specialist to whom they may refer. Why do we accept this as the norm in financial services? How can you ever be happy that your diagnosis accurately addressed your ailment? The diagnostician should not have any potential conflicts of interest, as they only serve to undermine an accurate diagnosis.

“You’ll see only what you look for; you recognise only what you know”

Dr. M. Sosman

Outcome Centric Financial Services

If I could go back in time and influence some of the poor financial advice given to my father, it would have significantly improved the financial lives of my mum, sister, and I. The brokers/agents were never measured on the outcome of their advice, only the profit they made for their company.

We find ourselves in a situation where financial diagnoses are determined by product, profit, or preference and not the consumer’s own unique set of financial vital signs. It is endemic to financial services as a whole and will continue to support poor financial outcomes until the industry changes; or is changed by the consumer themselves.