Some of you may well remember the uncomfortable talk had with your parents, you know the one about the ‘birds and the bees’?

Time ensures we will never see our parents young, but it also ensures that we will, in all likelihood, have to involve ourselves in their ‘golden years’. So, like the uncomfortable talk our parents initiated with our young selves, the time will come for many of us to hold a similarly awkward conversation, with our aging parents, regarding their retirement.

Why is this necessary? Simply put, if our parents haven’t catered sufficiently for their retirement, the burden will arrive on our doorsteps, in one form or another. However, there are practical steps that can be taken to mitigate this.

Firstly, let us consider this cold fact: According to the National Treasury Statement, only 6% of South Africans can retire and maintain standards of living.

Back in the day, the majority of Retirement Annuities were sold via Life Assurance Companies and are referred to as ‘old generation’ Retirement Annuities. There is a strong likelihood that one, or both, of your parents have their retirement funds invested via ‘old generation’ retirement products.

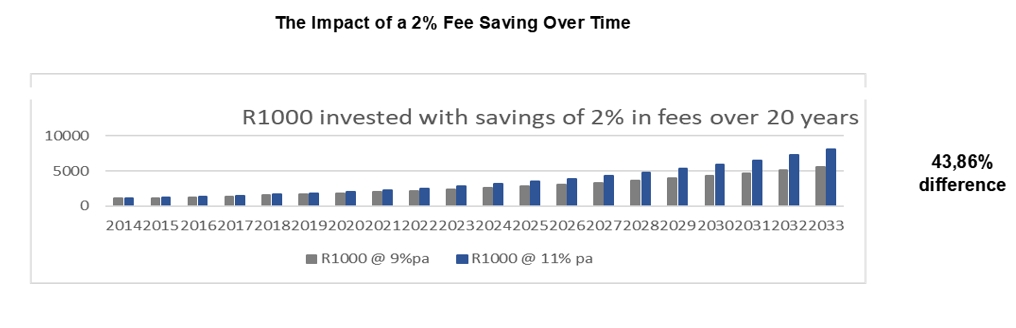

These structures are typically very expensive, and on average more than two percent per annum more costly than having a pure Investment or ‘new generation’ Retirement Annuity.

A two percent fee saving over twenty years can enhance retirement capital by forty four percent.

So, a million rand invested via a cost-efficient structure would yield over eight million rand after twenty years, versus a return of less than six million invested via the life assurers as shown in the below chart.

Ways to Improve Retirement Income:

- Be Cost Effective

Start the process by emigrating one’s retirement annuity from ‘old generation’ to ‘new generation’. To do this, one will need to consult an Independent Financial Adviser (IFA), so that all factors can be taken into account. - Active Wealth Manager

Ensure funds are actively managed by the Wealth Manager – Harbour Wealth holds a CATII license allowing our investment management team to make efficient and timeous changes to our clients’ models (Fund Selections), as and when deemed necessary. - Retirement Planning

Much has changed in the past ten years in terms of retirement legislation. There is never a bad time to review one’s current retirement situation so that accurate and appropriate modeling and forecasting exercises can completed. This is critical as it allows us to see into the future and determine just how ‘uncomfortable’ that talk with our loved ones will be. - Tax-Free Investment

Everyone should be aware of this relatively new avenue of investing funds. Essentially, every citizen is entitled to invest a portion of their discretionary capital tax-free, and almost every citizen should be taking advantage of this.

Contribution parameters as follows:

R36 000p.a, to a maximum of R500,000 invested over a lifetime.

What if my parents are already retired?

That old adage applies, better late than never.

Some trusted guidelines to enhance one’s post retirement:

- Seek independent advice, not all advisers are truly ‘conflict-free’.

- Try and stick as close as possible to the ‘five percent’ draw down rule.

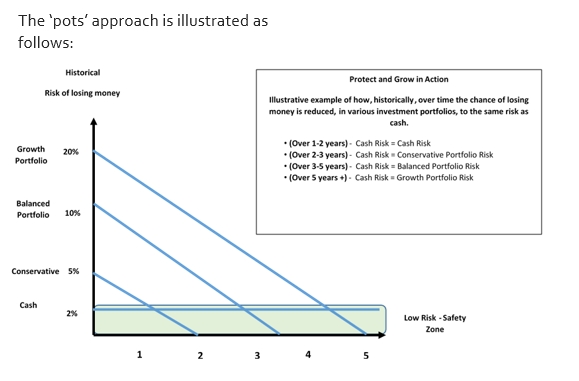

That is where one only draws five percent, or less, against retirement capital per annum. - Make use of the ‘pots’ approach regarding retirement capital and income growth, as follows:

* Two years needed income invested into an Income Model.

* The next two years of income invested into a Conservative Model.

* A further two years into a Balanced model. (Moderate).

* The balance of capital invested into a Growth model.

The result is that one has six years of income invested at the same risk inherent in a bank deposit. The balance, and majority, of one’s capital is invested into a growth model where the risk of loss equates to that of a bank deposit considering the time horizon. Every two years the solution is rebalanced, so that the respective ‘pot’ balances are restored. This process ensures that no growth assets are sold to provide income. By doing this one is able to extend retirement capital and income by 23%.

Conclusion:

By following these simple steps one could boost their parents’ pre-retirement capital by forty-three percent, and their post retirement capital by as much as twenty-three percent. That’s a sixty-six percent retirement boost one could make by simply sitting down and having a pro-active, or ‘birds-and-bees’esque’ type discussion with the folks.

At Harbour Wealth we follow these steps as part of our daily routine, so please get in touch so that we can begin converting this way of thinking into a better way of living.

If you require professional financial advice contact one of our qualified independent Financial Advisors at www.harbourwealth.co.za