As a young individual who has just started my working career, I know how hard it can be to save a portion of my salary each month. Fortunately for me, I have the privilege of working in an environment where the importance of saving for the future is stressed daily. Below I have highlighted some of the more important benefits of starting to save from a young age and how this will make your future and more importantly your retirement less stressful.

Compounding

Compounding – known as the 8th Wonder of the World – is the most important reason to start saving early! Compound interest is known as interest on interest. In other words when you earn interest on your initial invested amount, as well as on the reinvested interest portion. Another benefit of compounding is that you do not need to save big amounts every month if you start early.

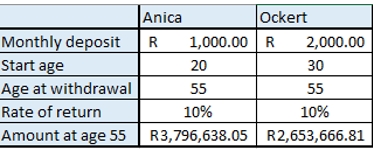

Here is an example to indicate the effects of compound interest when investing from a young age:

Anica starts saving at age 20 and Ockert starts saving at age 30. Anica saves R 1000 at the end of each month for 35 years and Ockert saves R 2000 at the end of each month for 25 years (they both have a rate of return of 10%). Due to compounding, Anica’s savings were worth more at age 55, even though she contributed less than Ockert each month.

Fewer expenses

Early on in life you do not have as many monthly overhead expenses. For example, you may not have a family that you need to provide for nor may you have big monthly bond, loan or rental repayments. This allowing you to have more disposable income to save.

Prepared for emergencies

By starting young it allows you to save a portion towards an emergency fund (in case of an emergency or unforeseen event) whilst the balance can be invested for your future needs and retirement in a more aggressive portfolio, knowing that you should not have to disinvest these funds if an emergency arises.

You learn financial discipline

When you begin to save early, you learn financial discipline. By saving a portion of your salary every month, you instill the habit of saving more and spending less. This also helps to distinguish between your wants and needs.

Reduce your investment risk

One thing that you can be certain about is that markets are volatile and involve a lot of uncertainty, especially over a short period of time. When you start saving at a younger age, your investment time horizon is far longer. The longer your investment time horizon, the more time there is for your investments to recover from any short-term market movements.

Recover from previous investment mistakes

Not everyone is lucky enough to get their investment choices right the first time. You could have invested in a fund that has continuously underperformed, paid fees that are unreasonably high or in a fund that did not match your risk profile – only to name a few. When you start saving early, you give yourself the opportunity to recover from these mistakes as you have more time on your side.

Create wealth for future generations

By starting to save at a young age, you should be able to provide for yourself one day, including your loved ones. Hopefully you will be able to provide them with financial security and pass some of your wealth on to the next generation. With that being said, you would also need to ensure that the next generation has financial discipline and follows in your footsteps of hard work and commitment!

From the above points, it is clear that saving from a young age is truly vital. For those investors who started early, they will agree that it has made their financial future and retirement less stressful. If you or your children have not started saving yet, it is never too late to start.

If you would like guidance on how to start your savings journey in the most tax and cost efficient manner, please feel free to get in touch with one of our qualified independent Financial Advisors: www.harbourwealth.co.za